The White House is expected to announce its highly anticipated plan on student loan debt today. However, with less than 10 days until the current pause on repayments is set to lift on Sept. 1, the department has yet to communicate its plans to student loan servicers, who are raising red flags about anticipated operational disruptions that will likely lead to a mess of confused borrowers due to the last-minute decision.

Discussions with White House officials reported by NBC show that Biden is considering extending the payment pause for many months as well as canceling up to $10,000 in student debt per borrower for those earning less than $125,000. With less than 10 days until the current pause is set to lift on Sept. 1, student loan servicers have not received any indication from the White House or the Education Department on their final plans, which the White House says are not yet final.

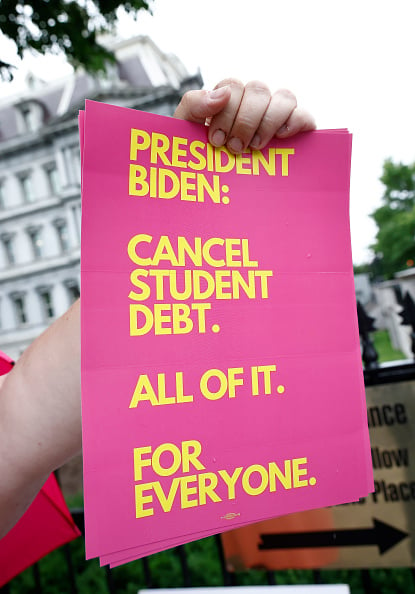

Biden’s announcement is expected to affect the balances of a third of the 40 million Americans with federal student loan debt—however, his plan is unlikely to please everyone. Many liberals want more debt forgiveness, and many Republicans want no forgiveness. The announcement is expected to have large political implications for the administration.

Republicans have long argued that the president does not have the authority to cancel student loan debt via executive order. They also argue that cancellation could increase inflation and will benefit high-income graduates.

On the other hand, Democrats and civil rights activists have asked Biden to relieve as much as $50,000 in student loans per borrower in order to truly provide relief to Black borrowers, who owe an average of $25,000 more in student loan debt than white college graduates.

“President Biden’s decision on student debt cannot become the latest example of a policy that has left Black people—especially Black women—behind. This is not how you treat Black voters who turned out in record numbers and provided 90 percent of their vote to once again save democracy in 2020,” said Derrick Johnson, president of the NAACP.

An analysis from Penn Wharton at the University of Pennsylvania released today found that a debt relief plan of $10,000 per borrower for those making under $150,000 a year would cost the federal government $298.4 billion. The same analysis found that 58 percent of debt relief under this plan would go to borrowers making under $82,000 a year.

Letter From Loan Servicers

A letter obtained by Inside Higher Ed from the Student Loan Servicing Alliance, the organization that represents the loan servicers that oversee 95 percent of all federal student loans, was sent to the Education Department on Monday. The letter said that loan servicers are in a “precarious position” and unprepared to quickly adapt their systems to reflect a final decision from Biden on student loans.

“Ten days is grossly insufficient notice to reprogram the massive and interwoven systems that handle loan accounts, provide appropriate system testing time, and also construct and implement revised communication plans,” said Scott Buchanan, president of the Student Loan Servicing Alliance, in the letter.

Loan servicers rely on automatic communications to relay information to borrowers on upcoming payments. According to Buchanan, borrowers are typically given notice 45 days in advance of an upcoming payment. The department requires servicers to reach out to borrowers at least 21 days before an upcoming payment is due. Servicers were instructed by the department not to send billing statements to borrowers in anticipation that payment would resume on Sept. 1.

Now, some servicers are racing to change their messaging systems as the Sept. 1 deadline nears. Some of these communications are sent automatically, and loan servicers are bracing for quick changes to their systems to reflect new updates from the Biden administration anticipated today.

“While servicers were instructed to hold back resumption communications and have worked to implement manual and systemic processes to try and suppress those communications[,] the core systems, programming, and call center training still reflect resumption occurring on Sept. 1. As the resumption date of Sept. 1 approaches, those manual processes and temporary work arounds used may begin to have fail points as more and more automated system transactions begin to be triggered, and there could be incidents of borrower miscommunication that will be a result of the lack of guidance in sufficient time for any operation,” said the letter.

Many borrowers are already confused. According to screenshots shared on Twitter last Thursday, one servicer, Nelnet, sent emails to borrowers enrolled in automatic reduction plans reminding them that an automatic payment would be deducted on Sept. 1. Later that day, Nelnet sent another email stating that the original email “shouldn’t have been sent” and that no payment would be withdrawn from borrowers’ accounts.

“If the payment pause is extended by the federal government, we will announce it at the top of the Nelnet.com homepage and post it to our Facebook and Twitter pages as soon as we are informed,” said Nelnet in the email. The email also said that a billing statement would be sent 21 days before a payment is due.

Nelnet did not respond to Inside Higher Ed when asked to confirm the screenshots.

Buchanan warned that without a final decision from the department, the less-then-10-day window given to loan servicers is not enough to avoid other administrative errors such as the one with Nelnet.

“The pattern has been that almost every major announcement—extensions or new programs—has been done with no official advance warning to servicers, schools, or others who do the work. This means we are all made unprepared to fully guide borrowers with good information and operationally have had insufficient time to lay in plans to ensure these changes go smoothly. There’s a big opportunity to work together collaboratively to make these implementations much better, and that will benefit the government’s borrowers,” Buchanan said to Inside Higher Ed.

The Education Department did not respond when asked by Inside Higher Ed about whether it has prepared loan servicers for the final announcement.

“Even today, we are hearing from borrowers who are experiencing distress and deep concern about what they need to do or not do and that call volume has increased, which is being caused by this lack of clarity created by the government that we hope can be resolved,” said the letter.

from Inside Higher Ed | News https://ift.tt/NLU8Bp5

No comments:

Post a Comment